Time for Alberta to end its love affair with low taxes

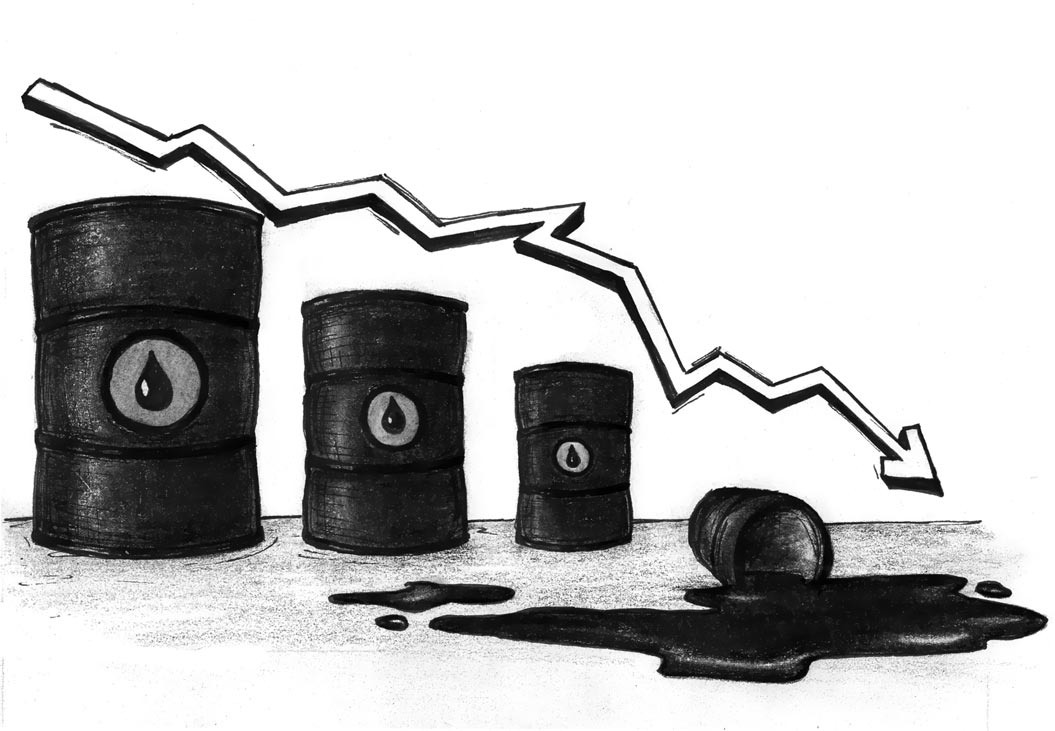

On Jan. 5, the price of oil fell below $50 a barrel, less than half of where it stood in June 2014. This spells trouble for Alberta’s government, which relies on oil revenue to pay for the roads we drive on, the hospitals that heal us and the degrees we’re working towards.

The growth of fracking in America and a decision by OPEC to keep oil production steady is behind the plummet. If prices stay low, Alberta Premier Jim Prentice says Alberta will face a revenue shortfall of $6.3 billion next budget, with billions more in the years to follow. This highlights the need to bring Alberta’s tax model in line with Canada’s other provinces to keep revenue stable.

Around 21 per cent of the government’s revenue comes directly from oil. When the cost per barrel is high, the province makes a killing while taxing Albertans little. But when prices drop, the easy money quickly disappears.

Last April, the government forecast that West Texas Crude, the standard benchmark price, would average $95 a barrel for the fiscal year. For every dollar below that price, Alberta stands to lose $215 million in tax revenue.

Prentice and the ruling Progressive Conservatives have done an admirable job acting surprised at $50-barrel prices. But similar drops happened under the tenure of every Alberta premier going back to Peter Lougheed.

In 2013, then-premier Alison Redford said in a tense TV address that a “bitumen bubble” would drain $6 billion from Alberta’s coffers. Like today’s PCs, Redford said “unpredictable” commodity markets would lead to “tough choices.” The government will make up the shortfall by cutting public services instead of raising taxes.

In the aftermath, post-secondary education was cut by seven per cent. The University of Calgary lost $40.7 million. They responded by cutting staff, canceling programs and cutting enrolment in arts, nursing and medicine.

Prentice has warned of similar cuts in the coming months. This would hurt people who are already vulnerable while protecting those who need it least.

Alberta is the only province in Canada with a flat income tax. Whether they make $50,000 or $5 million a year, all Albertans pay 10 per cent of their taxable income to the government. Alberta also has the lowest corporate tax rate in Canada, and it’s the only province without a sales tax.

By refusing to appropriately tax the wealthy, Alberta’s government makes significantly less than it could if it used other province’s tax models, according to Public Interest Alberta.

For example, Ontario has the second lowest income-tax rate for the wealthy in Canada while taxing those that make the least at five per cent instead of 10. If Alberta adopted Ontario’s income tax, the province could make $1.6 billion in additional revenue each year while cutting income tax for most residents. If we adopted the province’s tax structure as a whole, which includes a sales tax and a higher corporate tax, the government stands to make $14.7 billion.

According to the same estimates, if Alberta matched Manitoba’s income tax, which is high by Canadian standards, the government would raise an additional $7.3 billion, more than enough to make up for Alberta’s projected shortfall.

Like Alberta, Saskatchewan is a prairie province with a conservative government and a resource-based economy. If we adopted Saskatchewan’s income-tax rates the provincial government could raise an additional $3.8 billion. If we took their tax regime as a whole, $12.7 billion per year.

These solutions are obvious. But Prentice is favouring cuts to public services instead.

The Alberta government says construction on a new cancer centre could be delayed until 2020 because of falling revenue. The facility is needed to take pressure off the Tom Baker Cancer Centre, which, according to Alberta Cancer Foundation CEO Myka Osinuk, is “simply out of space” for new patients.

And let’s not forget that unpredictable funding was one of the reasons used for introducing market modifiers in December. These fees will cost U of C students in engineering, law and the MBA program thousands extra in tuition over the course of their degrees. Administration can justify imposing more fees like this if their funding is cut short. Students will once again have to pay for the government’s inability to manage its money in a volatile resource-based economy.

Don’t accept the tough-love paternalism from Prentice. Cancer patients, working families and students shouldn’t be expected to go without because 2015 looks like a bad year for oil prices.

This province is full of wealth that can be easily and fairly taxed. The individuals and companies who are benefiting most from Alberta’s natural resource should pay their dues.

Riley Hill, Gauntlet Editorial Board